Self-made wealth is increasingly driving investment decisions among Kenya’s High Net-Worth Individuals (HNWIs) in 2025. This is according to the global property consultant Knight Frank’s Wealth Report: Kenya Edition – Attitudes Survey 2025.

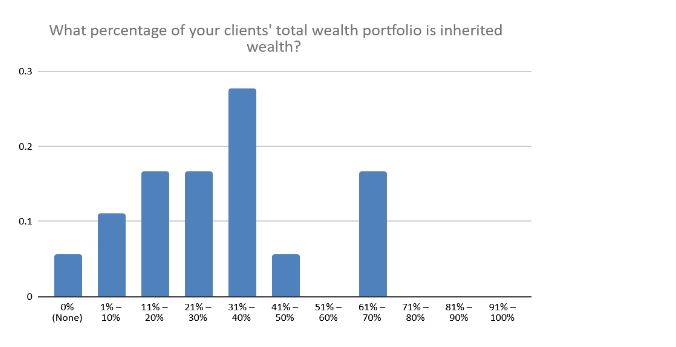

The Knight Frank report indicates that the majority of wealth managers report that most Kenyan HNWIs are now generating their wealth through diverse entrepreneurial ventures. The report also highlights a notable decline in the influence of inherited wealth, which now constitutes a minority share of HNWI portfolios. Half of the fund managers surveyed indicated that inheritance accounts for less than 30% of their client’s wealth, while 77% said it represents less than 40%.

However, the Knight Frank report also acknowledges that inheritance still plays a role in wealth accumulation among Kenyan HNWIs. Only 6% of wealth managers reported that their clients’ wealth was not inherited in any form.

Boniface Abudho, Research Analyst at Knight Frank, noted, “Most of Kenya’s wealthy tend to inherit assets, but they typically hold these in relatively conservative portfolios while focusing their efforts on generating new wealth through more productive and venturesome investments.”

In terms of allocation, fund managers reported that over half of inherited wealth is held in property, primarily in private rented residential real estate and real estate debt. Smaller allocations are directed towards the development of land and education.

In contrast, current investment preferences among HNWIs reflect a shift towards more entrepreneurial and growth-oriented sectors such as data centers, healthcare, hospitality, and industrial or commercial assets.

Notably, there is significantly reduced interest in private residential rentals and education compared to inherited wealth holdings.

Mark Dunford, CEO Knight Frank Kenya, observed: “In Kenya, inherited wealth typically takes the form of transferred real estate assets such as residential and land, with the younger generation being less sentimentally attached to legacy assets.”

Further, Knight Frank notes that the trend of leveraging inherited wealth as a foundation for progressive expansion into more venturesome investments is reflected in the relatively modest scale of new capital allocations. According to fund managers, nearly half (44%) of the investments planned by HNWIs for 2025 are valued at under US$ 5 million.

Mark Dunford added, “Overall, the data points to a pattern of landlord millionaires building on their existing wealth through targeted, smaller-scale investments across a broad range of commercial sectors. There is a clear emphasis on addressing emerging needs as a strategy for driving growth and sustained wealth creation.”