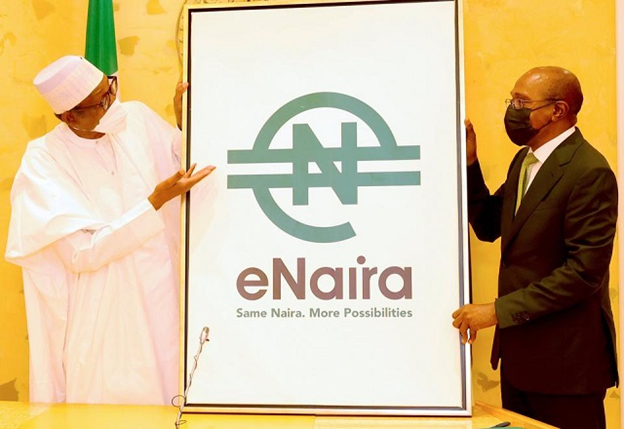

Nigerian President Muhammadu Buhari launched the country’s new digital eNaira currency on Monday as the nation looks to tap into the growing popularity of virtual money and cryptocurrencies. With the digital currency, Nigeria, which is considered Africa’s largest economy in terms of GDP and the continent’s most populous country with over 200 million people, becomes a pioneer on the continent, alongside Ghana, which has been testing its e-Cedi as a new means of exchange.

The eNaira also makes Nigeria the first in sub-Saharan Africa to fully launch a digital currency and joins China and other countries using or piloting central bank-regulated electronic tender.

“We have become the first country in Africa and one of the first in the world to introduce a digital currency to our citizens…” Buhari said at the official launch.

The director of communications of the Central Bank of Nigeria (CBN), Osita Nwasinobi, says the eNaira “marks a major step forward in the evolution of money and the CBN is committed to ensuring that the eNaira, like the physical Naira, is accessible by everyone… The theme of the eNaira is: ‘Same Naira, more possibilities.’”

“The launch of the eNaira is a culmination of several years of research work by the Central Bank of Nigeria,” the bank said in a statement on its Facebook page.

Nigeria’s Central Bank said that following the launch further modifications and enhancements would be made to allow all to benefit, especially those in rural areas and those without banking. President Buhari said the new digital currency is expected to improve cross-border trade, financial inclusion for people outside the formal economy and increase remittances.

What is the eNaira?

The eNaira will be an electronic version of the local paper naira currency, equal in value and issued by the Central Bank of Nigeria. It is not intended to replace cash but will function as a safe and efficient alternative means of payment.

How is the eNaira different from cryptocurrency like Bitcoin?

The eNaira will be a central bank digital currency, or CBDC, issued by the government, and it will have the same value as the paper, or fiat currency. CBDCs differ from cryptocurrencies in being regulated and therefore subject to banking laws. They are issued by a central authority and are therefore trusted by traders.

CBDC is described as a digital payment instrument, denominated in the national unit of account, while on the other hand cryptocurrency is built on block chain technology which ensures the decentralization of the creation, regulation, and use of cryptocurrency through the use of decentralized computer networks.

The blockchain technology on which cryptocurrencies are built makes them anonymous, however while transactions in eNaira will be made anonymous by the CBN, it will still have access to information provided by users and be able to trace transactions. As the eNaira has the same value as the physical naira, its value will rise or fall in relation to the dollar in the same way as the fiat currency. It is therefore unlikely to be as volatile as a cryptocurrency. The eNaira is also not in coins nor in notes, it’s in virtual format, meaning you can’t physically hold it, but you have it as a store of value, as a piece of payment; for every unit of the currency you hold, the central bank can give you physical naira.

Crypto-currencies are widely used in Nigeria, ranked in 2020 as the third largest user of virtual currencies in the world after the United States and Russia, by a study from specialist research firm Statista. With cryptocurrencies, Nigerians are mainly looking to escape the constant depreciation of the naira in recent years, and also this makes it easier for them to receive money from the diaspora or move their savings out of the country.

How do you get the eNaira?

The pilot launch will take place in Port Harcourt, Abuja, Kano and Lagos, and in the first phase digital currency will only be available to those who already have bank accounts. However, the eNaria is intended to be universal, meaning that it will eventually be possible to use it around the world to send and receive money or pay for goods and services.

To use eNaira, it will be necessary to create an eNaira wallet, which is digital storage managed by block chain technology. During the rollout, there will be just one version of the wallet, the government’s Speed Wallet, although financial institutions will be able to develop their own versions later. To create an eNaira wallet on a smartphone, users will need to download the eNaira app from either the Google Play Store or Apple Store and complete the registration process.

Unbanked Nigerians will be able to make transactions of up to N50,000 a day without the need for a bank account, while those with bank accounts will be able to send or receive money using a bank account or credit card linked to their eNaira wallet. It will be possible for customers to monitor their wallet, balances, and transaction history; money held in an eNaira wallet will not be paid any interest. Users will also be able to transfer money out of their digital wallets back to their ordinary bank account, but it will not be possible to withdraw physical naira from an ATM from the wallet.

Central banks around the world are looking to create digital versions of their currencies, known as CBDCs, in response to the growth of online payments and to compete with cryptocurrencies that are beyond the control of governments and global regulators. Nigeria is one of around 80 countries around the world that has been exploring the possibility. South Africa is moving towards a trial, while Ghana, Morocco, Tunisia, Kenya, and Madagascar are all reported to be in the research stages.