A historic plunge in the stock price of Facebook’s parent company has erased more than $230bn in its market value, easily the biggest one-day loss in history for a US company.

The firm also warned of slowing revenue growth in the face of competition from rivals like TikTok and YouTube, while advertisers are also cutting spending.

The Social media giant Facebook has also seen its daily active users (DAUs) drop for the first time in its 18-year history.

Facebook’s owner Meta Platforms says DAUs fell to 1.929bn in the three months to the end of December, compared to 1.930bn in the previous quarter.

Meta’s shares slumped by more than 20% in after-hours trading in New York.

The slide in Meta’s share price wiped around $200bn (£147.5bn) off the company’s stock market value.

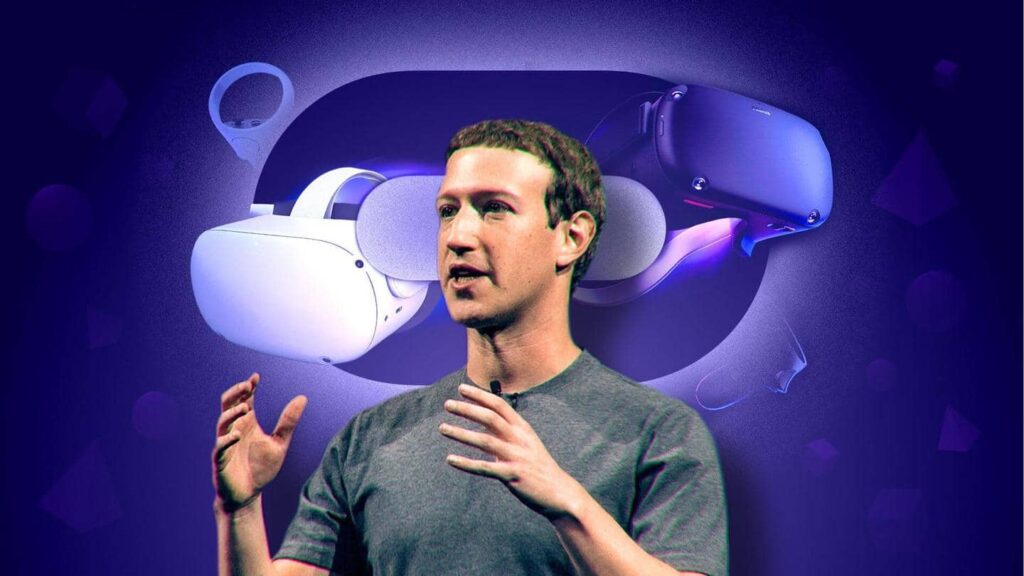

The slump in stock price has sent Mark Zuckerberg’s personal wealth tumbling by nearly $30bn.

Shares in other social media platforms, including Twitter, Snap and Pinterest, also fell sharply in extended trading.

Chief executive Mark Zuckerberg said the firm’s sales growth had been hurt as audiences, especially younger users, had left for rivals.

Meta, which owns the world’s second biggest digital advertising platform after Google, also said it had been hit by privacy changes on Apple’s operating system.

The changes have made it harder for brands to target and measure their advertising on Facebook and Instagram and could have an impact “in the order of $10 billion” for this year, according to Meta’s chief financial officer Dave Wehner.

Meta’s total revenue, the bulk of which comes from advertising sales, rose to $33.67bn in the period, narrowly beating market predictions.

It also forecast revenues of between $27bn to $29bn for the next quarter, which is lower than analysts had expected.

While the company has been making its own investments in video to compete with TikTok -owned by Chinese tech giant ByteDance – it makes less money from those offerings than its traditional Facebook and Instagram feeds.

Mr Zuckerberg said he was confident the investments in video and virtual reality would pay off, as previous bets on mobile advertising and Instagram stories have.

But, he noted, the firm didn’t have to contend with a major rival during previous shifts in strategy.

“The teams are executing quite well and the product is growing very quickly,” he said. “The thing that is somewhat unique here is that TikTok is so big a competitor already and also continues to grow at quite a fast rate.”

Facebook has always been a platform that grows.

For every quarter in its existence the global numbers have been in one direction.

Yet in the last few years, growth has stalled in Europe and US. That was masked by rises in users from the rest of the world.

Facebook just isn’t as popular with younger people as it was. By its own admission, TikTok is hurting business.